Numbers of leaves entitlement in a company depends upon state you are in. Every state has different leave entitlement and leave policies which should be seen before one defines leave policy of your company. Leave policy of a company cannot be less than that mentioned by the State’s shop and establishment act.

Earned Leave

This is a paid leave earned by employees during a year and availed in the subsequent year. If the number of earned leave is over, the day is considered as an unpaid leave and the day’s pay is cut from the salary. These leaves can also be en-cashed while leaving the company. The following are number of earned leaves according to laws:

Factory workers need to work minimum 240 days in the organization in a year to be eligible for earned leave. Adults get 1 day for every 20 days, and children, below the age of 15, get 1 day for every 15 days work in the previous year.Mine workers below the ground can avail 1 day for every 15 days work; and those working above the ground can avail 1 day for every 20 days work.Workers in a Bidi or Cigar factory get 1 day leave for every 20 days work in the previous year. If the worker is a child of below age 15, he gets 1 day off for every 15 days of work.People working in sales, and newspaper running company (which includes journalists) can avail one month earned leave for every 11 months of work.Domestic workers are also eligible for 15 days earned leave in a year.Casual Leave

This is another paid leave that although not earned, is entitled to employees only if prior permission is granted by the organization. If the employer does not grant permission and the employee nevertheless takes a leave, the day’s pay is cut from the salary. Usually every organization allows a certain number of casual leaves in a year, which is fixed by the company’s administration. Although, there is laws for certain types of workers:

Sales and newspaper employees (including journalists) are entitled 15 days of casual leave in a yearApprentices are entitled annually 12 days casual leaveSick/Medical Leave

Employers provide sick leaves to employees when they are ailing. Some organizations ask for a medical certificate to grant sick leave. Others don’t deem in necessary. If the employee has used up all his sick leaves, the company uses his earned leaves. Sick leaves can also be carried forward to the next year. The specifications are although determined by the company’s administration. Laws governing sick leaves for different types of employees are:

Apprentices are entitled for 15 days of sick leave in a year. This can be accumulated to a maximum of 40 days.Journalists and Newspaper employees can avail medical leave of one month for every 18 months of work. During the medical leave, the employees are paid half the day’s pay.Sales employees are entitled to medical leave similar to that of newspaper employees. They although mandatorily need to show a medical certificate for their absence.Maternity Leave

Female employees, as per law, are entitled to 3 months or 12 weeks of leave when she is pregnant. During this time, employers will have to pay their female employees normally.

Paternity Leave

Male employees who are soon to become fathers can avail upto 15 days of leave within 6 months of their wife’s date of delivery.

Apart from these, there are others paid, unpaid or half-paid leaves like Study Leave, Bereavement Leave and Leave for Voting. These although are left at the organization’s discretion.

Tata Steel Recruitment 2019:

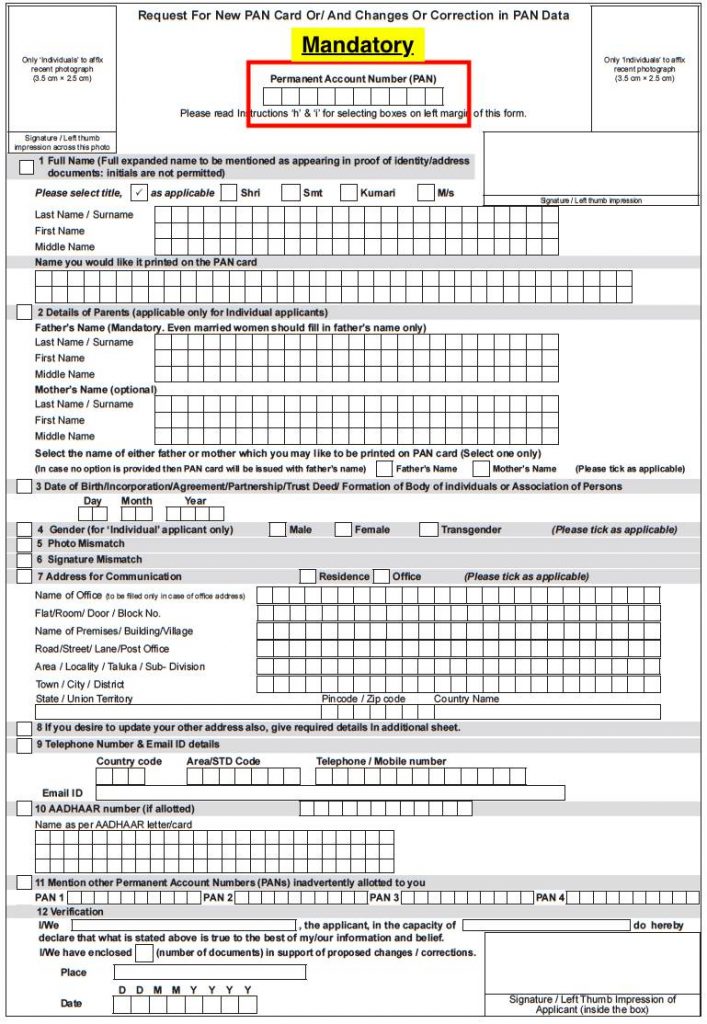

Tata Steel Recruitment 2019: Step 3: In case of any changes to the PAN, select the box on the left hand side of the form and update the information. In case of no changes, complete the form completely but do not select any box on left margin.

Step 3: In case of any changes to the PAN, select the box on the left hand side of the form and update the information. In case of no changes, complete the form completely but do not select any box on left margin.