Welcome to our study website, a comprehensive online platform designed to enhance your learning experience and support your academic journey. Whether you're a student, a professional, or simply a lifelong learner, our website offers a wealth of resources and tools to help you excel in your studies.At our study website, we understand the importance of effective studying techniques and the need for accessible and reliable educational materials.

Friday, August 10, 2018

HOW to start earn money easily.

Monday, June 18, 2018

Leave Policy in India

Numbers of leaves entitlement in a company depends upon state you are in. Every state has different leave entitlement and leave policies which should be seen before one defines leave policy of your company. Leave policy of a company cannot be less than that mentioned by the State’s shop and establishment act.

Earned Leave

This is a paid leave earned by employees during a year and availed in the subsequent year. If the number of earned leave is over, the day is considered as an unpaid leave and the day’s pay is cut from the salary. These leaves can also be en-cashed while leaving the company. The following are number of earned leaves according to laws:

Factory workers need to work minimum 240 days in the organization in a year to be eligible for earned leave. Adults get 1 day for every 20 days, and children, below the age of 15, get 1 day for every 15 days work in the previous year.Mine workers below the ground can avail 1 day for every 15 days work; and those working above the ground can avail 1 day for every 20 days work.Workers in a Bidi or Cigar factory get 1 day leave for every 20 days work in the previous year. If the worker is a child of below age 15, he gets 1 day off for every 15 days of work.People working in sales, and newspaper running company (which includes journalists) can avail one month earned leave for every 11 months of work.Domestic workers are also eligible for 15 days earned leave in a year.Casual Leave

This is another paid leave that although not earned, is entitled to employees only if prior permission is granted by the organization. If the employer does not grant permission and the employee nevertheless takes a leave, the day’s pay is cut from the salary. Usually every organization allows a certain number of casual leaves in a year, which is fixed by the company’s administration. Although, there is laws for certain types of workers:

Sales and newspaper employees (including journalists) are entitled 15 days of casual leave in a yearApprentices are entitled annually 12 days casual leaveSick/Medical Leave

Employers provide sick leaves to employees when they are ailing. Some organizations ask for a medical certificate to grant sick leave. Others don’t deem in necessary. If the employee has used up all his sick leaves, the company uses his earned leaves. Sick leaves can also be carried forward to the next year. The specifications are although determined by the company’s administration. Laws governing sick leaves for different types of employees are:

Apprentices are entitled for 15 days of sick leave in a year. This can be accumulated to a maximum of 40 days.Journalists and Newspaper employees can avail medical leave of one month for every 18 months of work. During the medical leave, the employees are paid half the day’s pay.Sales employees are entitled to medical leave similar to that of newspaper employees. They although mandatorily need to show a medical certificate for their absence.Maternity Leave

Female employees, as per law, are entitled to 3 months or 12 weeks of leave when she is pregnant. During this time, employers will have to pay their female employees normally.

Paternity Leave

Male employees who are soon to become fathers can avail upto 15 days of leave within 6 months of their wife’s date of delivery.

Apart from these, there are others paid, unpaid or half-paid leaves like Study Leave, Bereavement Leave and Leave for Voting. These although are left at the organization’s discretion.

Monday, June 11, 2018

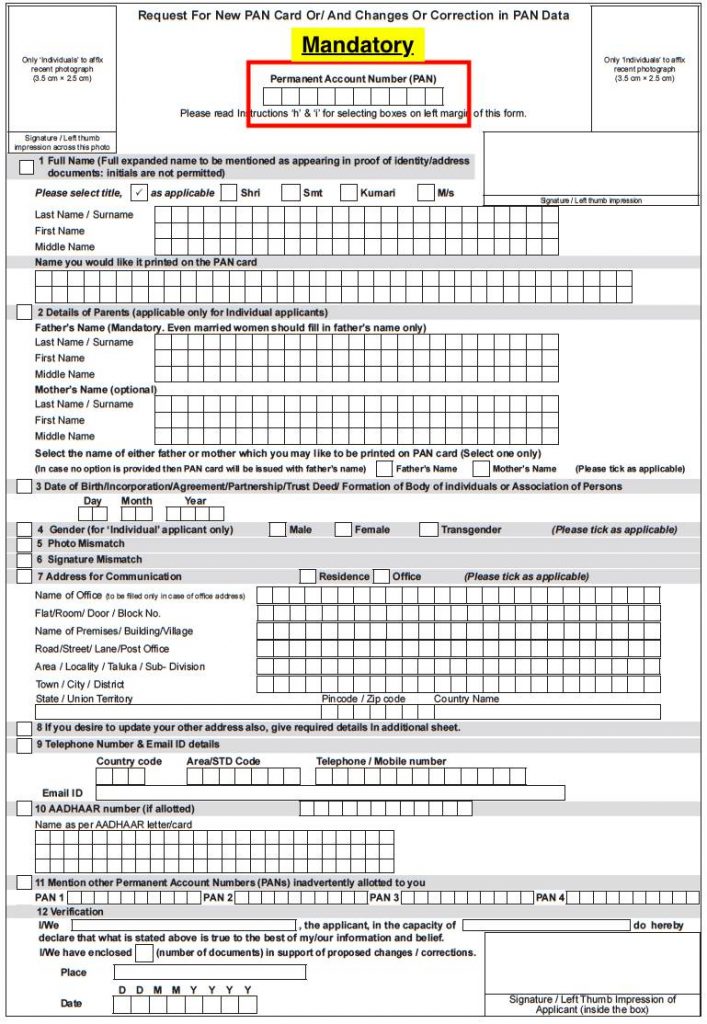

Lost PAN Card – Reapplication Procedure

Lost PAN Card Application

- NSDL Lost PAN Application

Step 3: In case of any changes to the PAN, select the box on the left hand side of the form and update the information. In case of no changes, complete the form completely but do not select any box on left margin.

Step 3: In case of any changes to the PAN, select the box on the left hand side of the form and update the information. In case of no changes, complete the form completely but do not select any box on left margin.- Copy of PAN card; or

- Copy of intimation letter issued by the Income Tax Department in lieu of PAN card intimating PAN.

- In case one of the above proofs are not available, a copy of FIR (stating loss of PAN card) can be submitted.

- Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8,Model Colony,

Near Deep Bungalow Chowk, Pune – 411 016.

Forgot PAN

Thursday, January 18, 2018

How to Link Aadhaar Number, Mobile Phone Using IVR for Re-Verification

How to link Aadhaar with mobile phone number

- When you call 14546, you will be asked to select whether you are an Indian national or an NRI by selecting the respective option

- Next, you will have to give consent to link Aadhaar with your phone number by pressing 1

- After that, you need to provide your Aadhaar number and press 1 to confirm

- This step generates the OTP, which you will receive on your mobile phone

- Now, you need to enter your phone number

- Here, you are asked to give consent to your operator to pick your name, photo and date of birth from UIDAI data base

- The IVR now mentions the last four digits of your number to confirm that you have keyed in the right number

- If the number is correct, you can enter the OTP you received on SMS

- You must press 1 to complete the Aadhaar-mobile number re-verification process

- If you hold another phone number, you can link that too by pressing 2 and following the steps provided by the IVR system. Keep your other mobile phone handy as you will receive the OTP on this number

Check your EPF Account Balance in 6 Easy Steps

Check your EPF Account Balance in 6 Easy Steps

Sunday, January 14, 2018

Reliance Jio planning its own cryptocurrency called JioCoin

Reliance Jio planning its own cryptocurrency called JioCoin

Great opportunity to earn 💰 as platinum coins Offer register and earn digital coins.

Dashboard Account Overview

Exchange Online PLT Coin Marketplace

We have filed documentation of registering PLT Coin as independent business entity and we are waiting for final approval from registrar of companies. As soon as we get our documentation done we will be able to start the process of exchange launch. We will update more details after registration approval

- We Have Upgraded the Buy Coins System, Now When you buy PLT Coins with Bitcoins They will Reflect in Your Account Instantly, and will Come in Your Premium Wallet. You Can Transfer and Sell Premium Coins only.

- Premium Coins Holders Will be Listed on Our Website as Featured Distributors.

- If you paid bitcoins but not received your PLT Coins yet, create a support ticket Here

0.047

0.0000033

₹ 3

50000000

50000000

kids drawing

How to Encourage Your Kids to Draw. Drawing is a fun and creative activity that can help your kids express themselves, develop their imagina...

-

What are the best VPN for China and which should I choose? In a nutshell, if you are looking for a VPN that has good performance, it’s e...

-

How to Encourage Your Kids to Draw. Drawing is a fun and creative activity that can help your kids express themselves, develop their imagina...

-

Busywin 17 Rel 6.2 GST ( Free) Link. Direct Download BUSY Accounting Software is an integra...